In this article, we will answer some of the most commonly asked questions by individuals seeking life insurance after being diagnosed with liver cirrhosis. The questions we will address include:

- Is it possible to qualify for life insurance with a cirrhosis diagnosis?

- Why do life insurance companies consider Cirrhosis a risk factor?

- What type of information will be requested by insurance companies?

- What is the range of potential insurance rates?

- What steps can be taken to secure the best life insurance policy for personal needs?

Let’s explore these questions and find the answers you need.

Bạn đang xem: Life Insurance with Cirrhosis of the Liver. Everything You Need Know at a Glance!

Can I qualify for life insurance if I have been diagnosed with Cirrhosis of the liver?

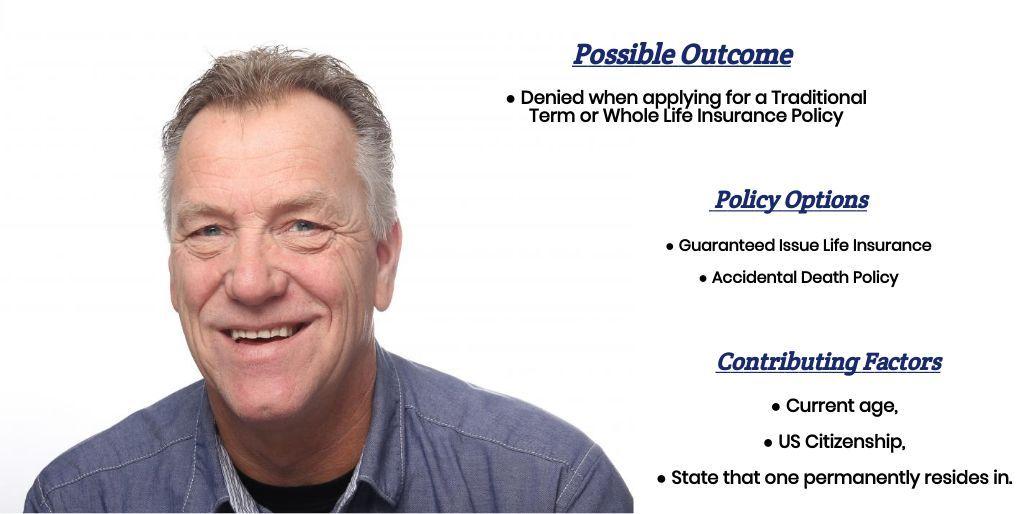

Yes and no. We say this because, for the most part, any individual diagnosed with Cirrhosis cannot qualify for a traditional life insurance policy, even if it’s a no medical exam term life insurance policy.

This means that…

Suppose an individual diagnosed with Cirrhosis still wishes to purchase a life insurance policy. In that case, they will need to pursue some kind of “alternative” product such as a guaranteed issue life insurance policy (AKA Final Expense Insurance) or an accidental death policy (which won’t provide a death benefit to anyone dying from a natural cause of death such as liver failure).

Or at least…

This is how it’s been in the past. We say this because, relatively recently, a couple of life insurance companies may be willing to offer an individual a “low limit” term life insurance policy if they can meet their application requirements. This is why we’ll usually answer this question by saying that it’s “technically possible” to qualify for life insurance if you have been diagnosed with liver cirrhosis. Still, the terms of the policy and the premiums you will be required to pay will likely be significantly affected by your condition.

Additionally…

The terms of a life insurance policy will depend on the insurer and the specific details of your situation, including the severity of your condition, your age, and any other underlying health conditions you may have. It is worth noting that life insurance policies for individuals with pre-existing conditions may have exclusions or limitations on coverage, and the premiums may be higher than those for individuals without pre-existing conditions.

Also…

It is important to carefully review the terms of any policy before you agree to it to ensure that you understand any exclusions or limitations and are comfortable with the premiums and other terms of the policy.

Why do life insurance companies care if I have been diagnosed with Cirrhosis of the liver?

Life insurance companies operate by assessing and managing risks. They issue policies and agree to pay benefits to beneficiaries when the insured person passes away. Policyholders’ premiums cover administrative costs and create a reserve to pay out claims.

When someone applies for a policy, the insurer evaluates various factors to determine the level of risk associated with insuring them. These factors include age, gender, overall health, pre-existing medical conditions, and risk factors. Cirrhosis of the liver is a significant risk factor since it is a severe and potentially life-threatening condition. Insurers also consider the severity of the disease, the stage of the condition, and any other underlying health conditions.

The insurer uses this information to assess the likelihood of the insured person’s death during the policy term and sets premiums accordingly. If an applicant with Cirrhosis of the liver is perceived to have an increased risk of death, the insurer may charge higher premiums to compensate for that risk. In some cases, the insurer may decline coverage altogether.

What kind of information will the insurance companies ask me or be interested in?

- When were you first diagnosed with Cirrhosis of the liver?

- Who diagnosed your Cirrhosis of the liver? A general practitioner or a specialist?

- What tests were performed to “reach” your diagnosis?

- What symptoms have you experienced (if any) which may have led to your diagnosis?

- Jaundice or yellowing of the skin?

- Fatigue,

- Weakness,

- Unexplained loss of appetite,

- Itching,

- Etc…

- What treatment options have you pursued to minimize the effects of your condition?

- Have you been diagnosed with any other pre-existing medical conditions?

- Do you suffer from or have you ever suffered from alcoholism?

- In the past 12 months, have you consumed any alcohol?

- In the past two years, have you been admitted to a hospital for any reason?

- Do you have any issues with your driving record? Issues such as multiple moving violations, a DUI, or a suspended license?

- Have you ever been convicted of a felony or misdemeanor?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

“This brings us to an important point we should mention.”

First…

If you have a medical issue, don’t use the internet to diagnose yourself. After all, if you do and you’re correct, you’ll still need to see the doctor, and if you’re wrong, the time you spend being your own doctor could cause significant harm to yourself!

Second…

Nobody here at IBUSA is medically trained; we’re certainly not doctors. All we are is a bunch of life insurance agents who just happened to be good at helping individuals find and qualify for the life insurance they’re looking for. So please don’t mistake any of the medical information we discuss as medical advice because it’s not!

Xem thêm : How Long Does It Take Probiotics To Work For BV?

We’re just trying to “prep” you for what it might be like to apply for a life insurance policy after you have been diagnosed with Cirrhosis… that’s it! This brings us to our next topic, which is…

What “rate” can I qualify for?

Now, historically, had you asked us what kind of “rate” an individual might be able to qualify for after having been diagnosed with Cirrhosis, we would have told you.

“That’s an easy question to answer because people with Cirrhosis can’t qualify for any rate!”

But now that it…

It appears that there are a couple of different life insurance companies who, at least on “paper,” claim that they will be willing to approve certain individuals a low-limit term life insurance policy; things have become quite a bit more complicated when it comes time to helping someone who has been diagnosed with Cirrhosis of the liver.

This is why we try to keep things a bit “vague” when talking about what someone may or may not be able to qualify for because now we may have a few more options than we did just a few months ago. That said, however, what we can say for sure is that anyone who has been diagnosed with Cirrhosis is only going to be able to qualify for a “high-risk” classification at best. Even then, their chances are probably going to be very slim!

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for. This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’ll find here at IBUSA!

Nguồn: https://buycookiesonline.eu

Danh mục: Info

This post was last modified on December 11, 2024 2:54 pm